Insights

Peering into a Tax Sunset

February 2, 2024

It’s a new year! Though not as newsworthy as geopolitics, the presidential election, or the eclipse, the sunset of many favorable tax provisions upon the close of 2025 is a topic worthy of your review now.

Starting in 2018, the Tax Cuts and Jobs Act (TCJA) lowered income tax rates, doubled the standard deduction as it curtailed many itemized deductions, and doubled the gift and estate tax exemption from $5.6 million to $11.2 million (indexed to inflation). Most of these provisions are scheduled to expire in twenty-four months, which would result in higher tax rates, a return to the previous deduction policy and, for some, greater exposure to federal estate taxes of 40% or more. While legislative action could forestall all or part of the sunset, that’s not likely to happen until after the November elections - perhaps at the very last minute, which would leave little time for taxpayers to make adjustments.

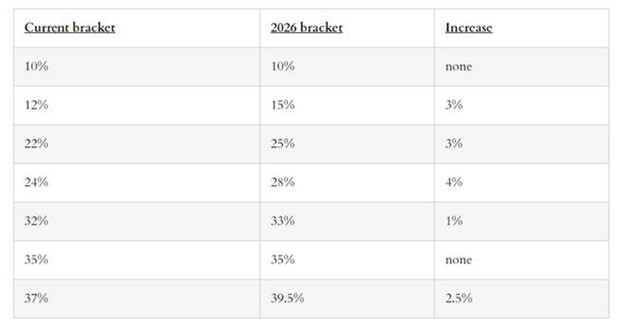

Currently Scheduled TCJA Income Tax Bracket Sunset Provisions Source: https://financialplaninc.com/your-future-income-tax-brackets-may-be-higher-than-you-assume/

Source: https://financialplaninc.com/your-future-income-tax-brackets-may-be-higher-than-you-assume/

A few sunset changes & actions to consider:

- Income tax brackets and rates revert to pre-2018 levels (see table above). Possible actions include income shifting - accelerating income and delaying expenses where practical. Explore the potential benefits of Roth conversions, which allow you to pay taxes on IRA distributions now rather than later, and subsequently compound returns income tax-free.

- The $10,000 limit on deductions for state and local taxes reverts to no limit. The expiration of this feature of the TCJA would be welcomed by those living in high tax states (Vermont comes to mind…). Itemized versus standard deduction policy will likely be a hotly debated topic in Congress prior to the sunset. Possible actions: review with your tax preparer to gauge the impact of upcoming changes on your return.

- The lifetime gift and estate exemption is halved if no legislative action is taken. The exemption would drop from the current level of $13.6 million to $6.8 million (before adjusting for inflation between 2024 and 2026). For those concerned about a larger estate tax liability, possible actions include gifting strategies designed to preserve the benefit of today’s high exemption threshold. A Roth conversion may be useful here as well, as it would reduce the size of an estate by the amount of taxes paid.

It is prudent to consult with your advisors about your exposure to the sunset. While the results of elections in November could play a large role in shaping tax policy in coming years, now is a great time to consider the possible outcomes and how they may affect you.

Retirement plan contribution limit changes for 2024:

- The limit on traditional and Roth IRA annual contributions increased from $6,500 to $7,000. The catch-up limit for those 50 and over remains $1,000. (There is still time to make a contribution for 2023!

- Increased limits for 401(k) and other qualified retirement plans.

Other recent changes to keep in mind:

- For those born between 1951 and 1959, required minimum distributions (RMDs) now start in the year you reach 73. For those born in 1960 and later, RMDs will start at 75.

- Qualified Charitable Distributions (QCDs) from a traditional or inherited IRA allow those over 70 ½ to make charitable gifts from their IRA without generating taxable income. QCDs can help satisfy annual RMDs and can conveniently be made by writing a check from your IRA.

- New laws implemented in 2023 allow individuals 70½ or older to make a one-time gift of up to $50,000 (adjusted annually for inflation) directly from an IRA to a charitable remainder unitrust, a charitable remainder annuity trust or a charitable gift annuity. We recommend consulting with us as well as the appropriate tax and legal professionals as part of a comprehensive planning effort.

- In some states (not yet in Vermont), up to $35,000 of “leftover” funds in a 529 Plan can be rolled into a Roth IRA for the person named as beneficiary of the plan. Important limitations apply and eligibility should be confirmed with your tax preparer.